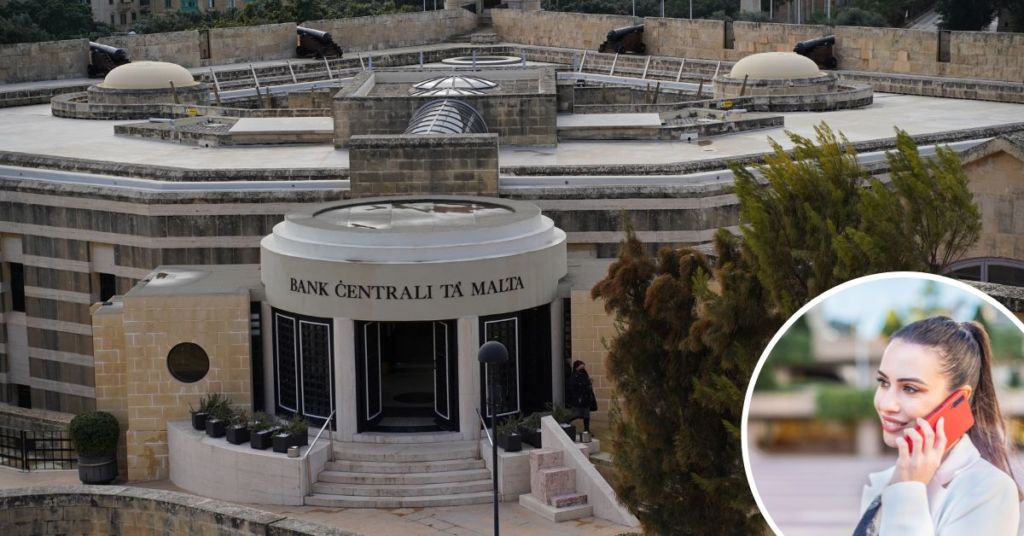

Malta Central Bank ‘Told Telecoms Operators To Stop Surcharging Customers For Electronic Payments’

Malta’s Central Bank has said it instructed telecoms operators to stop surcharging customers for electronic payments, in line with new EU rules, but denied claims that it told them to change their pricing structure.

The Central Bank issued a right of reply after telecoms operator Melita published a statement responding to questionable changes in their tariffs that will see people who don’t pay their bills via direct debit or pre-authorised credit card charged an extra €1 a month.

Melita said it will revise its pricing structure as of 1st July “in line with instructions received from the Central Bank of Malta” that are based on the provisions of the revised EU Payment Services Directive.

However, the Central Bank said that it never instructed telecoms operators to revise their pricing structures, only to adhere to the provisions of a directive it had issued, in line with the EU Payment Services Directive II, “to discontinue the practice of surcharging customers for electronic payments”.

“The Central Bank had initially given a deadline for operators to come in line with the Directive by 21st December 2021,” it said.

“However, following a request by the operators to have sufficient time for them to make the necessary preparations to discontinue such practice, the CBM extended the deadline to the end of April 2022, with a final extension granted to the end of May 2022.”

“In its letter to each operator separately, the CBM expressly stated that it expected operators ‘to have independently engaged with the respective competent authorities to obtain an approval of changes (if any) to the fees’ they intend to charge for their services.”

“The CBM is not a competent authority in this regard, and therefore it could not instruct operators to revise prices or approve revisions thereof as it has no such mandate.”

“The CBM would like to inform the public that the use of direct debits is a regulated and effective method of payment that safeguards consumers, including through the right to consumers to withdraw or recall payments even after their execution.”

PL MEP Alex Agius Saliba

Melita, along with GO and Epic, are currently being investigated by the Competition Office for alleged cartel activity after they announced new tariffs, ranging between €1 and €2, for non-direct debit users at around the same time.

The issue was first flagged by PL MEP Alex Agius Saliba, who warned their decision will likely have the most impact on pensioners who aren’t comfortable with online banking services.

However, Melita insisted that it has been applying a €1 charge to customers who don’t pay their bills automatically through Direct Debit Mandate or Pre-Authorised Credit Card for “many years”.

“It will now be replaced by an increase in price of €1 for Melita products,” it said. “This means that the extra cost of manual processing of payment has now been incorporated into the price of the product rather than being applied separately.”

Do you think this is an example of price-fixing?